Work With Us

What we expect from our employees

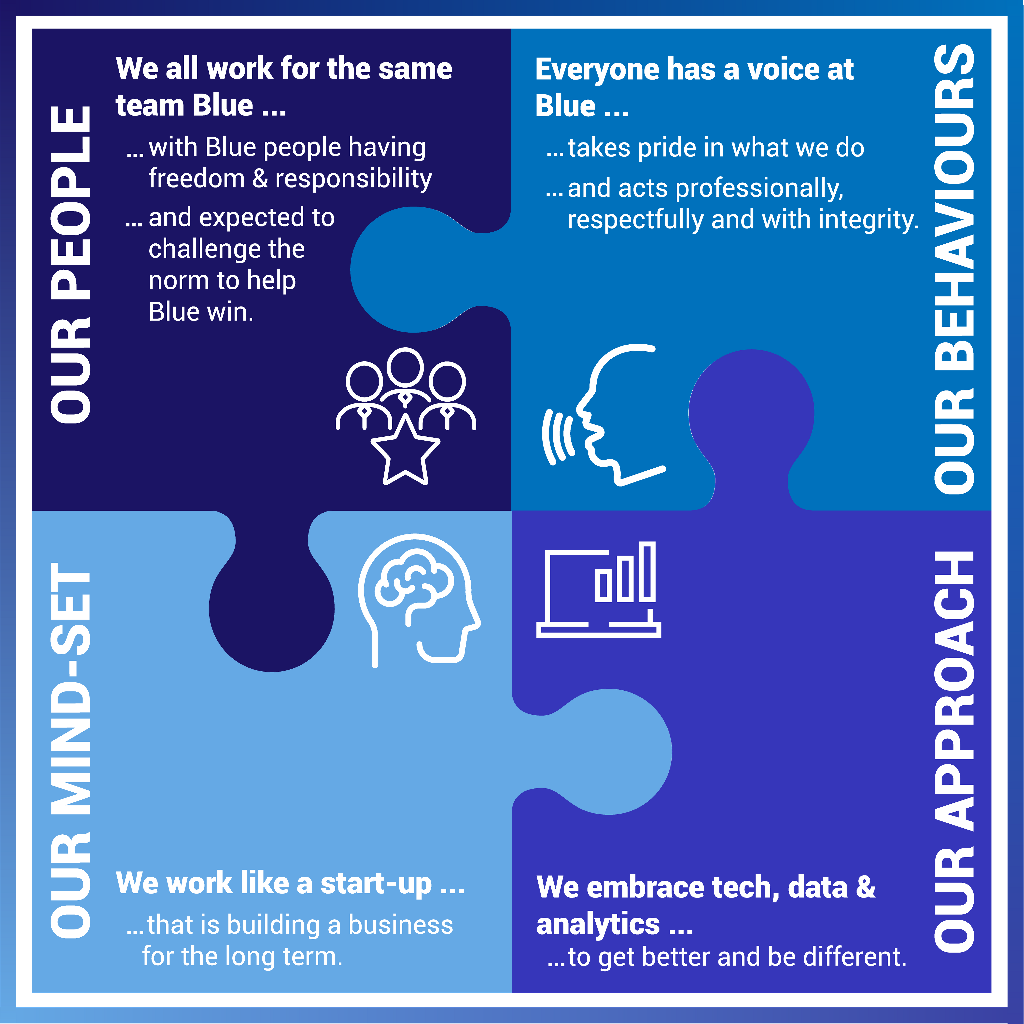

We all play for team Blue – We are collaborative, empathetic, energetic, fair, helpful, inclusive, supportive and we build lasting relationships.

We take responsibility – We are accountable, creative, influential and problem solvers. We have integrity and pride. We take ownership.

We work like a start-up – We are customer-focused, adaptable, innovative, pragmatic,proactive and resilient.

We have a voice and every door is open – We actively listen, get involved, openly communicate. We seek guidance and are open-minded.

Blue Benefits

As a valued member of the Blue team, you will get:

- 25 Days Annual Leave Entitlement

- One additional day’s leave for your birthday

- Private Medical Cover

- Life Insurance Cover

- Self-Invested Pension Plan (SIPP)

- Employee Assistance Programme (EAP)

- Access to Blue Motor Finance benefits portal

- Gym Membership discounts

- Eye Care Cost reimbursement

- Premium Bonds for children

- Office Social Activities

- Tusker

- Tech Scheme

- Cycle to Work

- Employee referral scheme

- Occupational parental pay after 12 months continuous service at the beginning of the 11th week before the EWC

- Challenging and exciting work environment

- Continuous development

Current jobs at Blue

Our people are the key to our success and we are proud of our high calibre teams. We empower our people to take initiative, challenge the norm, think for themselves and make decisions to deliver an exemplary service. We recruit the best, forward thinking, creative people to work at Blue. We want our people to inspire our future!

We have big plans for the future and you could be part of them. Take a look below to see if you have what it takes to be part of Team Blue and view our current vacancies.

Commercial Team at Blue

At Blue, our commercial operations are structured into three core regional teams supported by a National Accounts Department, under the strategic leadership of our Chief Commercial Officer. Our Commercial Directors guide regional operations, closely assisted by Regional Directors who lead teams of Relationship Managers to achieve strategic business commercial objectives.

Overall purpose of the role

The Regional Manager is accountable for acquiring and managing introducers within an assigned region, focusing exclusively on Blue’s defined target market. You will onboard new dealer partners using our compelling dealer package (subject to change), designed to drive value for both Blue and our introducers. In addition to acquisition, you’ll manage introducer performance, focusing on maintaining a sustainable weighted average commission, addressing any clawbacks or other forms of debt promptly whilst delivering consistent volume and quality case flow.

Key responsibilities and accountabilities

Introducer Acquisition and Onboarding

- Proactively identify, target, and onboard new introducers aligned with our defined target market strategy.

- Present and explain Blue’s value proposition and dealer package effectively to maximise conversion.

- Ensure a smooth onboarding experience and successful ramp-up in production.

- Commercial Delivery and Performance Management

- Consistently deliver agreed case volume and lending targets within your region.

- Maintain a strong pipeline of introducer opportunities and submit accurate business forecasts.

- Analyse performance data and take proactive steps to meet and exceed targets.

Relationship Management

- Own and manage relationships with assigned dealers, ensuring engagement, retention, and profitability.

- Act as the key point of contact for introducers, ensuring timely responses and resolution of any issues.

- Support introducers with training, deal structuring, and product education to drive volume and quality.

Commission and Commercial Oversight

- Monitor and manage introducer weighted average commission to align with Blue’s commercial expectations.

- Identify and manage risks associated with over-commissioning or unprofitable introducer performance.

- Proactively manage any clawbacks or debt recovery issues, escalating where necessary in collaboration with the Regional Director.

- Develop and maintain a full understanding of the Company’s compliance requirements (including the Financial Conduct Authority’s Conduct Rules) and act in accordance with the standards, instructions in, and the spirit of those requirements.

- Take responsibility for ensuring that personal data within your remit is handled lawfully, fairly, and in line with the company’s data protection policies and procedures. Collaborate with the Data Protection Officer to ensure compliance with data protection standards, guidelines, and principles, acting in a manner that upholds these requirements while supporting the DPO’s overall oversight responsibilities.

- For customer data, ensure it is processed securely and in accordance with data privacy obligations to protect the rights of individuals.

- For employee personal data, handle it with strict confidentiality and in compliance with employment and data protection legislation.

- Act to deliver good outcomes for our customers and understand how this requirement specifically applies to your role at Blue.

Compliance and Market Conduct

- Maintain a working knowledge of FCA conduct rules and ensure introducer behaviours and processes are compliant.

- Handle customer and introducer data lawfully and responsibly, adhering to all data protection and internal governance policies.

- Act always to deliver good outcomes for customers and understand how this requirement specifically applies to your role at Blue.

Reporting and Administration

- Keep accurate, up-to-date records of introducer interactions, onboarding progress, performance, and escalations.

- Contribute market feedback and competitor intelligence to your Regional Director to support regional strategy.

- Attend regular 1-1s and regional commercial business meetings, bringing insight and actions that support the wider team goals.

Person specification

- Demonstrated success in introducer or dealer commercial roles within motor finance or a sector.

- Commercially sharp, with experience managing pricing and commission negotiations.

- Target-driven, tenacious, and proactive in approach to commercial activity and relationship building.

- Strong interpersonal and communication skills, capable of building trust quickly.

- Resilient and self-motivated with high personal accountability.

- Familiar with FCA compliance and regulatory standards.

- Full UK Driving Licence and access to a vehicle for regular regional travel.

Additional requirements

- This is a field-based role with substantial regional travel.

- Flexibility to work occasional evenings or weekends where business needs demand.

- Willingness to undertake training and continuous professional development as required.

Apply for this role

Commercial Team at Blue

At Blue, our commercial operations are structured into three core regional teams supported by a National Accounts Department, under the strategic leadership of our Chief Commercial Officer. Our Commercial Directors guide regional operations, closely assisted by Regional Directors who lead teams of Relationship Managers to achieve strategic business commercial objectives.

Overall purpose of the role

The Regional Executive is accountable for acquiring and managing introducers within an assigned region, focusing exclusively on Blue’s defined target market. You will onboard new dealer partners using our compelling dealer package (subject to change), designed to drive value for both Blue and our introducers. In addition to acquisition, you’ll manage introducer performance, focusing on maintaining a sustainable weighted average commission, addressing any clawbacks or other forms of debt promptly whilst delivering consistent volume and quality case flow.

Key responsibilities and accountabilities

Introducer Acquisition and Onboarding

- Proactively identify, target, and onboard new introducers aligned with our defined target market strategy.

- Present and explain Blue’s value proposition and dealer package effectively to maximise conversion.

- Ensure a smooth onboarding experience and successful ramp-up in production.

- Commercial Delivery and Performance Management

- Consistently deliver agreed case volume and lending targets within your region.

- Maintain a strong pipeline of introducer opportunities and submit accurate business forecasts.

- Analyse performance data and take proactive steps to meet and exceed targets.

Relationship Management

- Own and manage relationships with assigned dealers, ensuring engagement, retention, and profitability.

- Act as the key point of contact for introducers, ensuring timely responses and resolution of any issues.

- Support introducers with training, deal structuring, and product education to drive volume and quality.

Commission and Commercial Oversight

- Monitor and manage introducer weighted average commission to align with Blue’s commercial expectations.

- Identify and manage risks associated with over-commissioning or unprofitable introducer performance.

- Proactively manage any clawbacks or debt recovery issues, escalating where necessary in collaboration with the Regional Director.

- Develop and maintain a full understanding of the Company’s compliance requirements (including the Financial Conduct Authority’s Conduct Rules) and act in accordance with the standards, instructions in, and the spirit of those requirements.

- Take responsibility for ensuring that personal data within your remit is handled lawfully, fairly, and in line with the company’s data protection policies and procedures. Collaborate with the Data Protection Officer to ensure compliance with data protection standards, guidelines, and principles, acting in a manner that upholds these requirements while supporting the DPO’s overall oversight responsibilities.

- For customer data, ensure it is processed securely and in accordance with data privacy obligations to protect the rights of individuals.

- For employee personal data, handle it with strict confidentiality and in compliance with employment and data protection legislation.

- Act to deliver good outcomes for our customers and understand how this requirement specifically applies to your role at Blue.

Compliance and Market Conduct

- Maintain a working knowledge of FCA conduct rules and ensure introducer behaviours and processes are compliant.

- Handle customer and introducer data lawfully and responsibly, adhering to all data protection and internal governance policies.

- Act always to deliver good outcomes for customers and understand how this requirement specifically applies to your role at Blue.

Reporting and Administration

- Keep accurate, up-to-date records of introducer interactions, onboarding progress, performance, and escalations.

- Contribute market feedback and competitor intelligence to your Regional Director to support regional strategy.

- Attend regular 1-1s and regional commercial business meetings, bringing insight and actions that support the wider team goals.

Person specification

- Demonstrated success in introducer or dealer commercial roles within motor finance or a sector.

- Commercially sharp, with experience managing pricing and commission negotiations.

- Target-driven, tenacious, and proactive in approach to commercial activity and relationship building.

- Strong interpersonal and communication skills, capable of building trust quickly.

- Resilient and self-motivated with high personal accountability.

- Familiar with FCA compliance and regulatory standards.

- Full UK Driving Licence and access to a vehicle for regular regional travel.

Additional requirements

- This is a field-based role with substantial regional travel.

- Flexibility to work occasional evenings or weekends where business needs demand.

- Willingness to undertake training and continuous professional development as required.

Apply for this role

Commercial Team at Blue

At Blue, our commercial operations are structured into three core regional teams supported by a National Accounts Department, under the strategic leadership of our Chief Commercial Officer. Our Commercial Directors guide regional operations, closely assisted by Regional Directors who lead teams of Relationship Managers to achieve strategic business commercial objectives.

Overall purpose of the role

The Regional Executive is accountable for acquiring and managing introducers within an assigned region, focusing exclusively on Blue’s defined target market. You will onboard new dealer partners using our compelling dealer package (subject to change), designed to drive value for both Blue and our introducers. In addition to acquisition, you’ll manage introducer performance, focusing on maintaining a sustainable weighted average commission, addressing any clawbacks or other forms of debt promptly whilst delivering consistent volume and quality case flow.

Key responsibilities and accountabilities

Introducer Acquisition and Onboarding

- Proactively identify, target, and onboard new introducers aligned with our defined target market strategy.

- Present and explain Blue’s value proposition and dealer package effectively to maximise conversion.

- Ensure a smooth onboarding experience and successful ramp-up in production.

- Commercial Delivery and Performance Management

- Consistently deliver agreed case volume and lending targets within your region.

- Maintain a strong pipeline of introducer opportunities and submit accurate business forecasts.

- Analyse performance data and take proactive steps to meet and exceed targets.

Relationship Management

- Own and manage relationships with assigned dealers, ensuring engagement, retention, and profitability.

- Act as the key point of contact for introducers, ensuring timely responses and resolution of any issues.

- Support introducers with training, deal structuring, and product education to drive volume and quality.

Commission and Commercial Oversight

- Monitor and manage introducer weighted average commission to align with Blue’s commercial expectations.

- Identify and manage risks associated with over-commissioning or unprofitable introducer performance.

- Proactively manage any clawbacks or debt recovery issues, escalating where necessary in collaboration with the Regional Director.

- Develop and maintain a full understanding of the Company’s compliance requirements (including the Financial Conduct Authority’s Conduct Rules) and act in accordance with the standards, instructions in, and the spirit of those requirements.

- Take responsibility for ensuring that personal data within your remit is handled lawfully, fairly, and in line with the company’s data protection policies and procedures. Collaborate with the Data Protection Officer to ensure compliance with data protection standards, guidelines, and principles, acting in a manner that upholds these requirements while supporting the DPO’s overall oversight responsibilities.

- For customer data, ensure it is processed securely and in accordance with data privacy obligations to protect the rights of individuals.

- For employee personal data, handle it with strict confidentiality and in compliance with employment and data protection legislation.

- Act to deliver good outcomes for our customers and understand how this requirement specifically applies to your role at Blue.

Compliance and Market Conduct

- Maintain a working knowledge of FCA conduct rules and ensure introducer behaviours and processes are compliant.

- Handle customer and introducer data lawfully and responsibly, adhering to all data protection and internal governance policies.

- Act always to deliver good outcomes for customers and understand how this requirement specifically applies to your role at Blue.

Reporting and Administration

- Keep accurate, up-to-date records of introducer interactions, onboarding progress, performance, and escalations.

- Contribute market feedback and competitor intelligence to your Regional Director to support regional strategy.

- Attend regular 1-1s and regional commercial business meetings, bringing insight and actions that support the wider team goals.

Person specification

- Demonstrated success in introducer or dealer commercial roles within motor finance or a sector.

- Commercially sharp, with experience managing pricing and commission negotiations.

- Target-driven, tenacious, and proactive in approach to commercial activity and relationship building.

- Strong interpersonal and communication skills, capable of building trust quickly.

- Resilient and self-motivated with high personal accountability.

- Familiar with FCA compliance and regulatory standards.

- Full UK Driving Licence and access to a vehicle for regular regional travel.

Additional requirements

- This is a field-based role with substantial regional travel.

- Flexibility to work occasional evenings or weekends where business needs demand.

- Willingness to undertake training and continuous professional development as required.

Apply for this role

Commercial Team at Blue

At Blue, our commercial operations are structured into three core regional teams supported by a National Accounts Department, under the strategic leadership of our Chief Commercial Officer. Our Commercial Directors guide regional operations, closely assisted by Regional Directors who lead teams of Relationship Managers to achieve strategic business commercial objectives.

Overall purpose of the role

The Regional Manager is accountable for acquiring and managing introducers within an assigned region, focusing exclusively on Blue’s defined target market. You will onboard new dealer partners using our compelling dealer package (subject to change), designed to drive value for both Blue and our introducers. In addition to acquisition, you’ll manage introducer performance, focusing on maintaining a sustainable weighted average commission, addressing any clawbacks or other forms of debt promptly whilst delivering consistent volume and quality case flow.

Key responsibilities and accountabilities

Introducer Acquisition and Onboarding

- Proactively identify, target, and onboard new introducers aligned with our defined target market strategy.

- Present and explain Blue’s value proposition and dealer package effectively to maximise conversion.

- Ensure a smooth onboarding experience and successful ramp-up in production.

- Commercial Delivery and Performance Management

- Consistently deliver agreed case volume and lending targets within your region.

- Maintain a strong pipeline of introducer opportunities and submit accurate business forecasts.

- Analyse performance data and take proactive steps to meet and exceed targets.

Relationship Management

- Own and manage relationships with assigned dealers, ensuring engagement, retention, and profitability.

- Act as the key point of contact for introducers, ensuring timely responses and resolution of any issues.

- Support introducers with training, deal structuring, and product education to drive volume and quality.

Commission and Commercial Oversight

- Monitor and manage introducer weighted average commission to align with Blue’s commercial expectations.

- Identify and manage risks associated with over-commissioning or unprofitable introducer performance.

- Proactively manage any clawbacks or debt recovery issues, escalating where necessary in collaboration with the Regional Director.

- Develop and maintain a full understanding of the Company’s compliance requirements (including the Financial Conduct Authority’s Conduct Rules) and act in accordance with the standards, instructions in, and the spirit of those requirements.

- Take responsibility for ensuring that personal data within your remit is handled lawfully, fairly, and in line with the company’s data protection policies and procedures. Collaborate with the Data Protection Officer to ensure compliance with data protection standards, guidelines, and principles, acting in a manner that upholds these requirements while supporting the DPO’s overall oversight responsibilities.

- For customer data, ensure it is processed securely and in accordance with data privacy obligations to protect the rights of individuals.

- For employee personal data, handle it with strict confidentiality and in compliance with employment and data protection legislation.

- Act to deliver good outcomes for our customers and understand how this requirement specifically applies to your role at Blue.

Compliance and Market Conduct

- Maintain a working knowledge of FCA conduct rules and ensure introducer behaviours and processes are compliant.

- Handle customer and introducer data lawfully and responsibly, adhering to all data protection and internal governance policies.

- Act always to deliver good outcomes for customers and understand how this requirement specifically applies to your role at Blue.

Reporting and Administration

- Keep accurate, up-to-date records of introducer interactions, onboarding progress, performance, and escalations.

- Contribute market feedback and competitor intelligence to your Regional Director to support regional strategy.

- Attend regular 1-1s and regional commercial business meetings, bringing insight and actions that support the wider team goals.

Person specification

- Demonstrated success in introducer or dealer commercial roles within motor finance or a sector.

- Commercially sharp, with experience managing pricing and commission negotiations.

- Target-driven, tenacious, and proactive in approach to commercial activity and relationship building.

- Strong interpersonal and communication skills, capable of building trust quickly.

- Resilient and self-motivated with high personal accountability.

- Familiar with FCA compliance and regulatory standards.

- Full UK Driving Licence and access to a vehicle for regular regional travel.

Additional requirements

- This is a field-based role with substantial regional travel.

- Flexibility to work occasional evenings or weekends where business needs demand.

- Willingness to undertake training and continuous professional development as required.

Apply for this role

Commercial Team at Blue

At Blue, our commercial operations are structured into three core regional teams supported by a National Accounts Department, under the strategic leadership of our Chief Commercial Officer. Our Commercial Directors guide regional operations, closely assisted by Regional Directors who lead teams of Relationship Managers to achieve strategic business commercial objectives.

Overall purpose of the role

The Regional Manager is accountable for acquiring and managing introducers within an assigned region, focusing exclusively on Blue’s defined target market. You will onboard new dealer partners using our compelling dealer package (subject to change), designed to drive value for both Blue and our introducers. In addition to acquisition, you’ll manage introducer performance, focusing on maintaining a sustainable weighted average commission, addressing any clawbacks or other forms of debt promptly whilst delivering consistent volume and quality case flow.

Key responsibilities and accountabilities

Introducer Acquisition and Onboarding

- Proactively identify, target, and onboard new introducers aligned with our defined target market strategy.

- Present and explain Blue’s value proposition and dealer package effectively to maximise conversion.

- Ensure a smooth onboarding experience and successful ramp-up in production.

- Commercial Delivery and Performance Management

- Consistently deliver agreed case volume and lending targets within your region.

- Maintain a strong pipeline of introducer opportunities and submit accurate business forecasts.

- Analyse performance data and take proactive steps to meet and exceed targets.

Relationship Management

- Own and manage relationships with assigned dealers, ensuring engagement, retention, and profitability.

- Act as the key point of contact for introducers, ensuring timely responses and resolution of any issues.

- Support introducers with training, deal structuring, and product education to drive volume and quality.

Commission and Commercial Oversight

- Monitor and manage introducer weighted average commission to align with Blue’s commercial expectations.

- Identify and manage risks associated with over-commissioning or unprofitable introducer performance.

- Proactively manage any clawbacks or debt recovery issues, escalating where necessary in collaboration with the Regional Director.

Compliance and Regulation

Develop and maintain a full understanding of the Company’s compliance requirements (including the Financial Conduct Authority’s Conduct Rules) and act in accordance with the standards, instructions in, and the spirit of those requirements.

Take responsibility for ensuring that personal data within your remit is handled lawfully, fairly, and in line with the company’s data protection policies and procedures. Collaborate with the Data Protection Officer to ensure compliance with data protection standards, guidelines, and principles, acting in a manner that upholds these requirements while supporting the DPO’s overall oversight responsibilities.

For customer data, ensure it is processed securely and in accordance with data privacy obligations to protect the rights of individuals.

For employee personal data, handle it with strict confidentiality and in compliance with employment and data protection legislation.

Act to deliver good outcomes for our customers and understand how this requirement specifically applies to your role at Blue.

Compliance and Market Conduct

Maintain a working knowledge of FCA conduct rules and ensure introducer behaviours and processes are compliant.

Handle customer and introducer data lawfully and responsibly, adhering to all data protection and internal governance policies.

Act always to deliver good outcomes for customers and understand how this requirement specifically applies to your role at Blue.

Reporting and Administration

- Keep accurate, up-to-date records of introducer interactions, onboarding progress, performance, and escalations.

- Contribute market feedback and competitor intelligence to your Regional Director to support regional strategy.

- Attend regular 1-1s and regional commercial business meetings, bringing insight and actions that support the wider team goals.

Person specification

- Demonstrated success in introducer or dealer commercial roles within motor finance or a sector.

- Commercially sharp, with experience managing pricing and commission negotiations.

- Target-driven, tenacious, and proactive in approach to commercial activity and relationship building.

- Strong interpersonal and communication skills, capable of building trust quickly.

- Resilient and self-motivated with high personal accountability.

- Familiar with FCA compliance and regulatory standards.

- Full UK Driving Licence and access to a vehicle for regular regional travel.

Additional requirements

- This is a field-based role with substantial regional travel.

- Flexibility to work occasional evenings or weekends where business needs demand.

- Willingness to undertake training and continuous professional development as required.

Apply for this role

Commercial Team at Blue

At Blue, our commercial operations are structured into three core regional teams supported by a National Accounts Department, under the strategic leadership of our Chief Commercial Officer. Our Commercial Directors guide regional operations, closely assisted by Regional Directors who lead teams of Relationship Managers to achieve strategic business commercial objectives.

Overall purpose of the role

The Regional Manager is accountable for acquiring and managing introducers within an assigned region, focusing exclusively on Blue’s defined target market. You will onboard new dealer partners using our compelling dealer package (subject to change), designed to drive value for both Blue and our introducers. In addition to acquisition, you’ll manage introducer performance, focusing on maintaining a sustainable weighted average commission, addressing any clawbacks or other forms of debt promptly whilst delivering consistent volume and quality case flow.

Key responsibilities and accountabilities

Introducer Acquisition and Onboarding

- Proactively identify, target, and onboard new introducers aligned with our defined target market strategy.

- Present and explain Blue’s value proposition and dealer package effectively to maximise conversion.

- Ensure a smooth onboarding experience and successful ramp-up in production.

- Commercial Delivery and Performance Management

- Consistently deliver agreed case volume and lending targets within your region.

- Maintain a strong pipeline of introducer opportunities and submit accurate business forecasts.

- Analyse performance data and take proactive steps to meet and exceed targets.

Relationship Management

- Own and manage relationships with assigned dealers, ensuring engagement, retention, and profitability.

- Act as the key point of contact for introducers, ensuring timely responses and resolution of any issues.

- Support introducers with training, deal structuring, and product education to drive volume and quality.

Commission and Commercial Oversight

- Monitor and manage introducer weighted average commission to align with Blue’s commercial expectations.

- Identify and manage risks associated with over-commissioning or unprofitable introducer performance.

- Proactively manage any clawbacks or debt recovery issues, escalating where necessary in collaboration with the Regional Director.

- Develop and maintain a full understanding of the Company’s compliance requirements (including the Financial Conduct Authority’s Conduct Rules) and act in accordance with the standards, instructions in, and the spirit of those requirements.

- Take responsibility for ensuring that personal data within your remit is handled lawfully, fairly, and in line with the company’s data protection policies and procedures. Collaborate with the Data Protection Officer to ensure compliance with data protection standards, guidelines, and principles, acting in a manner that upholds these requirements while supporting the DPO’s overall oversight responsibilities.

- For customer data, ensure it is processed securely and in accordance with data privacy obligations to protect the rights of individuals.

- For employee personal data, handle it with strict confidentiality and in compliance with employment and data protection legislation.

- Act to deliver good outcomes for our customers and understand how this requirement specifically applies to your role at Blue.

Compliance and Market Conduct

- Maintain a working knowledge of FCA conduct rules and ensure introducer behaviours and processes are compliant.

- Handle customer and introducer data lawfully and responsibly, adhering to all data protection and internal governance policies.

- Act always to deliver good outcomes for customers and understand how this requirement specifically applies to your role at Blue.

Reporting and Administration

- Keep accurate, up-to-date records of introducer interactions, onboarding progress, performance, and escalations.

- Contribute market feedback and competitor intelligence to your Regional Director to support regional strategy.

- Attend regular 1-1s and regional commercial business meetings, bringing insight and actions that support the wider team goals.

Person specification

- Demonstrated success in introducer or dealer commercial roles within motor finance or a sector.

- Commercially sharp, with experience managing pricing and commission negotiations.

- Target-driven, tenacious, and proactive in approach to commercial activity and relationship building.

- Strong interpersonal and communication skills, capable of building trust quickly.

- Resilient and self-motivated with high personal accountability.

- Familiar with FCA compliance and regulatory standards.

- Full UK Driving Licence and access to a vehicle for regular regional travel.

Additional requirements

- This is a field-based role with substantial regional travel.

- Flexibility to work occasional evenings or weekends where business needs demand.

- Willingness to undertake training and continuous professional development as required.

Apply for this role

Equal Opportunities statement

We are committed to equality of opportunity for all staff and applications from individuals are encouraged regardless of age, disability, sex, gender reassignment, sexual orientation, pregnancy and maternity, race, religion or belief and marriage and civil partnerships and offending background.

Privacy Information

For details on your rights under data protection legislation and how we gather and use your personal information when you apply to work with us. Please see our Recruitment Privacy Notice